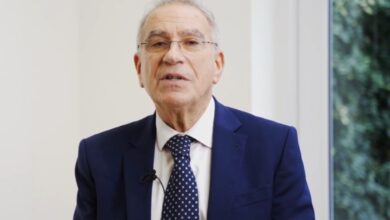

Dan Neidle: A Tax Realist Leading the Charge for Transparency

Dan Neidle is a name synonymous with transparency and fairness in tax policy. As a British tax lawyer, founder of Tax Policy Associates Ltd, and an influential voice in UK tax discussions, Neidle has made significant contributions to public understanding of complex tax issues. His expertise spans decades, including high-profile investigations into tax practices and policy.

The Career of Dan Neidle: From Clifford Chance to Tax Policy Associates

Dan Neidle began his illustrious legal career at Clifford Chance, one of the world’s leading law firms. Over 24 years, he ascended through the ranks, eventually becoming the UK’s Head of Tax in 2020. In this role, Neidle advised corporations, governments, regulators, and NGOs on various tax-related issues, including cryptocurrency, EU law, and Brexit.

In May 2022, Neidle made a bold move by leaving Clifford Chance to establish Tax Policy Associates Ltd. This nonprofit organization aims to provide impartial advice on tax policy, assist journalists investigating tax evasion and avoidance, and collaborate with academics researching tax policy. Uniquely, the nonprofit operates independently without donations, fees, or commercial work, ensuring unbiased analysis and advice.

Dan Neidle’s High-Profile Investigations

Nadhim Zahawi’s Tax Controversy

In 2022, Neidle brought to light discrepancies in Nadhim Zahawi’s tax affairs. Zahawi, the then-Chancellor of the Exchequer, was alleged to have used offshore trusts to avoid nearly £4 million in capital gains tax on his stake in YouGov. Neidle’s investigation led to Zahawi settling with HMRC for £3.7 million, including penalties and interest. Ultimately, this controversy resulted in Zahawi being dismissed from the Cabinet by Prime Minister Rishi Sunak.

Angela Rayner’s Capital Gains Tax Allegations

In April 2024, Neidle commented on allegations involving Angela Rayner, Deputy Leader of the Labour Party, regarding her payment of Capital Gains Tax. While some questioned her claims of residence at the property in question, Neidle emphasized that the central issue might not affect the tax implications, calling for further clarification.

Property118 and Landlord Tax Avoidance Schemes

Property118, an unregulated adviser, promotes tax avoidance schemes targeting buy-to-let landlords. Neidle critically analyzed these schemes, warning of potential financial risks, including increased tax liabilities and mortgage defaults. His detailed reports highlighted significant legal and financial pitfalls, encouraging landlords to seek qualified tax advice before engaging in such strategies.

Dan Neidle’s Personal Life and Family

Dan Neidle values family deeply. Married with children, he has shared anecdotes about how his wife only discovered his legal profession six months into their relationship. His decision to retire from Clifford Chance was partly influenced by his desire to spend more time with his family, demonstrating his commitment to personal priorities alongside professional achievements.

Financial Standing: Dan Neidle’s Net Worth

As of 2024, Dan Neidle’s net worth is estimated to be approximately $1.03 million. While modest compared to other professionals in his field, this figure reflects his dedication to non-profit work and his choice to prioritize integrity and public service over personal financial gain.

Dan Neidle on Social Media and Public Influence

Neidle is an active voice on platforms like Twitter (now X), where he shares insights on UK and international tax law. In December 2024, he topped the #ICAEWROAR rankings as the UK’s leading accounting influencer, further cementing his status as a thought leader in his field.

Education and Early Life

Born in 1973, Dan Neidle is currently 51 years old (as of 2024). He pursued his undergraduate studies in Physics at the University of Bristol, where he graduated with a Bachelor of Science degree. Following this, he transitioned into law, completing his legal training at the College of Law in London. He earned both a Common Professional Examination (CPE) in 1996 and a Legal Practice Course (LPC) in 1997. This solid educational background laid the foundation for his highly successful career in tax law.

Awards and Recognitions

Neidle’s work has earned him significant accolades, including:

- Investigation of the Year at the British Journalism Awards 2023.

- Outstanding Contribution to Taxation at the 2023 Tolley’s Taxation Awards.

- Inclusion among the 50 Most Influential People in Tax Policy by the International Tax Review in 2024.

Dan Neidle’s Role in Public Tax Policy

Dan Neidle’s commitment to improving public understanding of tax extends beyond individual investigations. His nonprofit organization has shaped discussions on tax evasion, policy reforms, and accountability, earning him widespread respect among policymakers, journalists, and the public.

Related Topics and Future Impact

In addition to his high-profile cases, Neidle has been linked to various significant tax discussions, including:

- Michelle Mone Tax Issues: Investigating potential discrepancies in tax filings.

- Farmers and Taxation: Advocating for fair tax policies in the agricultural sector.

- The Labour Party’s Tax Policies: Offering expert commentary on proposed reforms.

- Post Office Tax Disputes: Addressing systemic challenges in the UK’s tax infrastructure.

Conclusion: A Visionary for Transparency

Dan Neidle has solidified his reputation as a tax realist, combining expertise, independence, and a relentless pursuit of fairness. Through his nonprofit, social media presence, and investigations, he has made a lasting impact on UK tax policy and public accountability. Whether discussing the tax affairs of public figures or advising on complex policy issues, Neidle’s work exemplifies integrity and expertise. His contributions continue to shape the future of tax transparency and fairness.